The Rise of Venture Capital

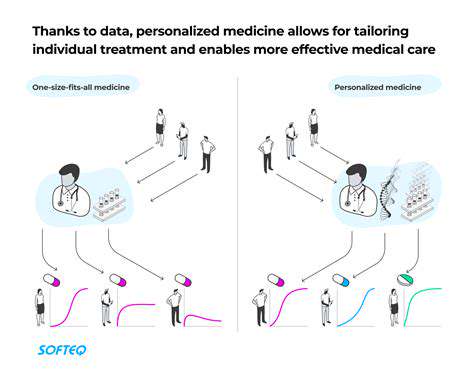

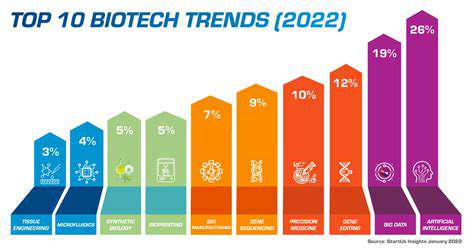

Venture capital (VC) firms are increasingly recognizing the potential of biotech innovations, leading to a significant influx of funding into the sector. This surge in investment is driven by the promise of groundbreaking therapies and diagnostic tools, offering the potential for substantial returns. Investors are particularly drawn to companies focused on areas like gene therapy, immunotherapy, and personalized medicine. The evolving regulatory landscape and the growing demand for innovative healthcare solutions are also contributing factors.

The competitive landscape is becoming more intense as established VC firms and new players vie for a piece of the action. This heightened competition is pushing startups to develop innovative strategies and demonstrate a clear path to market. This dynamic environment fosters rapid innovation and fuels the advancement of life-saving treatments and technologies, ultimately benefiting patients worldwide.

Public Market Opportunities

Beyond venture capital, public markets are also playing a crucial role in the biotech funding landscape. Initial Public Offerings (IPOs) are providing a vital source of capital for established biotech companies, allowing them to expand their research and development efforts and commercialize their products. This access to public capital is essential for scaling operations and accelerating the transition of promising treatments from the lab to the clinic. The success of these IPOs often depends on the company's clinical trial outcomes and market projections.

The increasing number of biotech companies going public reflects the growing confidence in the sector's long-term potential. Investors are drawn to the potential for high returns, particularly in sectors with promising therapeutic targets. The ability to secure public funding is often a key factor in a company's ability to succeed in this highly competitive landscape.

Government Funding and Initiatives

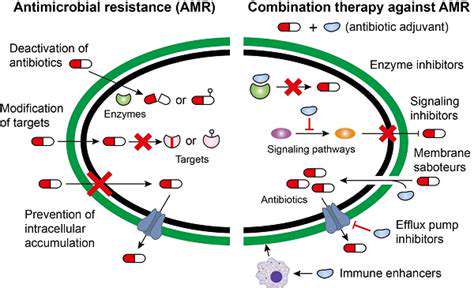

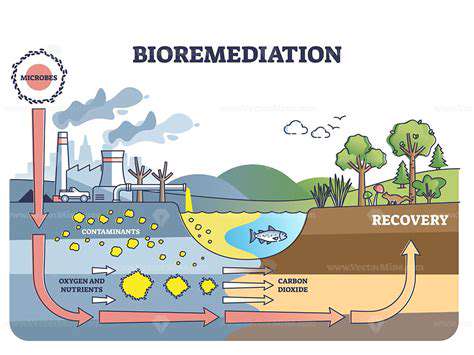

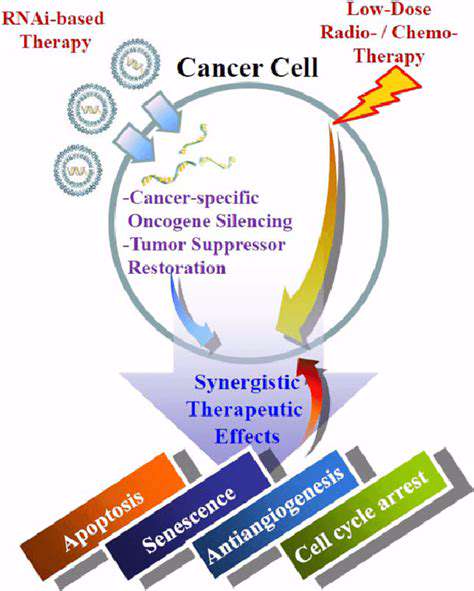

Government funding plays a significant role in supporting the biotech industry and fostering innovation. Numerous grants and funding opportunities are available to researchers and startups, providing crucial support for early-stage development. These initiatives often focus on areas of national health priorities, such as infectious diseases and cancer research. This support is vital in accelerating the development of new drugs, therapies, and diagnostics, ultimately improving healthcare outcomes.

Private Equity and Strategic Partnerships

Private equity firms are increasingly interested in the biotech sector, recognizing its potential for substantial returns. They often target companies with established products or technologies poised for commercialization. Strategic partnerships between biotech companies and pharmaceutical giants are becoming increasingly common, allowing for the rapid advancement of promising therapies and the shared costs of development and commercialization. These collaborations can accelerate the development process and provide access to broader distribution networks.

These strategic collaborations leverage the combined expertise and resources of different organizations. This can lead to faster development of new treatments and technologies, ultimately benefiting patients and the healthcare system as a whole. The biotech funding landscape is evolving rapidly, with private equity and strategic alliances emerging as significant players.

The Impact of VC on Biotech Research and Development

Venture Capital's Role in Fueling Biotech Research

Venture capital (VC) plays a crucial role in funding and accelerating biotech research by providing the necessary capital for early-stage companies to conduct groundbreaking experiments and develop innovative treatments. This funding allows researchers to explore new avenues of discovery, test hypotheses, and potentially bring life-saving therapies to market. VC investment fosters a dynamic environment, driving progress in the field of biotechnology.

Early-stage biotech companies often face significant financial hurdles. VC funding bridges this gap by providing the capital needed for research and development, allowing researchers to pursue ambitious projects that might otherwise be unattainable. This injection of capital is critical for advancing scientific knowledge and developing novel treatments for various diseases.

Attracting VC Investment: A Critical Aspect

Securing VC funding requires a compelling business plan, a strong scientific foundation, and a talented team. A well-defined strategy, outlining the potential market for the company's product or service, is essential for attracting investors. Demonstrating a clear understanding of the target market and the potential for commercial success is paramount.

Presenting a robust scientific rationale and intellectual property strategy is also critical. Investors need to be convinced that the research is sound and that the company has a clear path to commercialization. A comprehensive understanding of the competitive landscape and a well-defined strategy for navigating it is also crucial.

Impact on Research and Development

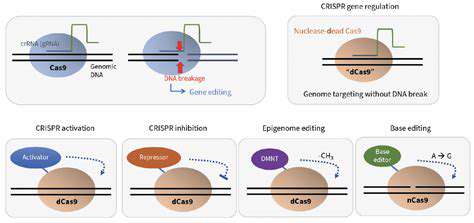

VC funding significantly impacts the pace and direction of research and development in the biotech sector. By supporting early-stage companies, VC investment encourages innovation and the development of novel therapies and diagnostics. This funding allows researchers to explore new technologies and approaches to complex medical challenges.

The financial backing from VC firms can accelerate the research process, enabling faster development cycles and the quicker translation of scientific discoveries into practical applications. This translates into potential breakthroughs in various fields of medicine.

Innovation and Commercialization

VC investment plays a vital role in driving innovation and commercialization within the biotech industry. By supporting early-stage companies, VCs foster a climate of creativity and experimentation, allowing for the development of novel technologies and treatments.

This support enables biotech companies to transition from the research phase to the commercialization phase, potentially leading to the development and distribution of life-saving therapies. The goal is not just to fund research, but to create commercially viable products that can benefit patients.

The Role of Intellectual Property

Robust intellectual property (IP) protection is crucial for attracting VC investment in biotech companies. Strong IP portfolios demonstrate the potential for commercial success and protect the company's innovations. Protecting intellectual property is essential to securing investment and preventing competitors from copying or utilizing the company's discoveries.

VC firms often look for companies with strong IP positions as a critical element in their investment decisions. This protection allows companies to leverage their research and development efforts for future commercialization.

Ethical Considerations and Societal Impact

While VC funding can significantly contribute to biotech advancements, it's crucial to consider the ethical implications of this funding. The potential for bias in investment decisions and the potential for prioritizing profit over patient needs must be addressed. The overall societal impact of these advancements, including equitable access to treatments and potential unintended consequences, must be thoroughly analyzed.

Careful consideration of the ethical dimensions of biotech research is crucial, as is a commitment to responsible innovation. This includes ensuring that research is conducted in a manner that aligns with ethical standards and that the benefits of the research are shared equitably across society.

Regulatory Landscape and Market Trends

Navigating the complex regulatory landscape is critical for biotech companies seeking VC funding. Thorough understanding of the regulatory requirements for new therapies and diagnostics is essential to ensure that the product development process aligns with legal standards. Regulatory compliance is a crucial factor for securing investment and ensuring the safety and efficacy of products.

Understanding market trends and competitive dynamics is vital for biotech companies seeking VC funding. Staying informed about the latest market research, emerging technologies, and competitive pressures is paramount for developing a successful business strategy. Thoroughly understanding the current and future market trends is essential for developing a sustainable business model.

The first stage of the social commerce funnel, awareness and discovery, is crucial for attracting potential customers. This phase is all about visibility and making your brand, products, or services known within the relevant social media ecosystems. It's about strategically positioning your content to resonate with your target audience, sparking initial interest, and encouraging further exploration.