The Rise of Biotechnology

The biotech sector is experiencing rapid growth, driven by groundbreaking advancements in genetic engineering, molecular biology, and other related fields. This surge in innovation is reshaping industries from healthcare and agriculture to environmental science. Biotechnology companies are developing innovative solutions to address global challenges, creating exciting opportunities for investment and career advancement.

From developing novel therapies for previously incurable diseases to creating sustainable agricultural practices, biotechnological advancements are pushing the boundaries of what's possible. This dynamic landscape presents a wealth of opportunities for entrepreneurs, scientists, and investors alike.

Genetic Engineering's Impact

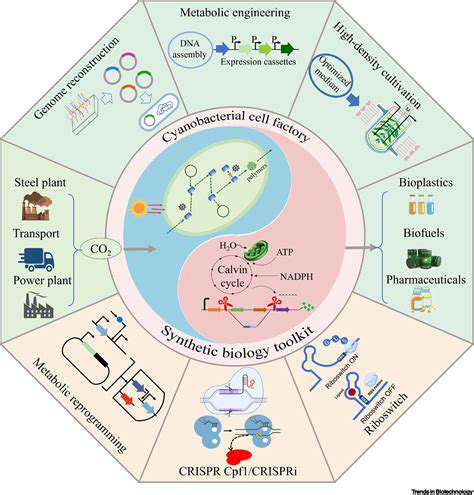

Genetic engineering, a cornerstone of biotechnology, is revolutionizing the way we understand and manipulate life at a fundamental level. Scientists are harnessing the power of DNA to create disease-resistant crops, develop new medicines, and even explore the potential of gene therapy for treating inherited diseases. The implications of these advancements are profound and far-reaching, impacting countless aspects of human life.

This powerful tool allows scientists to modify organisms in ways that were previously unimaginable. The potential for genetic engineering to solve critical global issues, like food security and disease eradication, is enormous.

Biopharmaceutical Innovations

Biopharmaceuticals, a key segment of the biotech industry, are leading the charge in developing cutting-edge therapies for a wide range of diseases. These innovative drugs are often more effective and targeted than traditional pharmaceuticals, leading to better patient outcomes. The development of monoclonal antibodies, for instance, has revolutionized cancer treatment and autoimmune disease management.

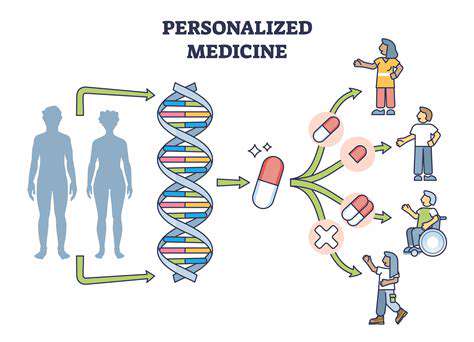

The focus on personalized medicine is also driving significant innovation in biopharmaceuticals, creating therapies tailored to individual patient needs. This approach promises improved efficacy and reduced side effects.

Agricultural Biotechnology

Agricultural biotechnology is transforming farming practices by developing crops that are more resilient to pests, diseases, and environmental stresses. These genetically modified organisms (GMOs) hold the potential to significantly increase crop yields and improve food security in a world with a growing population. Developing crops that require less water or are resistant to harsh weather conditions is critical for sustainable agriculture.

Environmental Biotechnology

Environmental biotechnology offers innovative solutions for addressing pressing environmental challenges. Companies are developing technologies to clean up pollutants, remediate contaminated sites, and produce biofuels. The potential for these technologies to mitigate the impacts of climate change is significant.

These advancements in bioremediation and biofuel production offer a sustainable path towards addressing the environmental issues facing our planet.

Investment Opportunities

The biotech sector presents a multitude of exciting investment opportunities for individuals and institutions. Investing in biotech companies can provide substantial returns, as these innovative ventures bring groundbreaking products and services to market. However, the sector is also characterized by significant risk, requiring careful due diligence and a long-term perspective.

Understanding the intricacies of the sector and the potential for high rewards, along with the inherent risks, is crucial for those considering investing in this dynamic market. Thorough research and a diversified portfolio are essential.

Ethical Considerations

As biotechnology advances, it's essential to consider the ethical implications of these innovations. Questions arise regarding the potential misuse of genetic engineering, the safety of novel therapies, and the equitable distribution of these technologies. Open dialogue and careful regulation are crucial to ensure that these advancements benefit humanity as a whole.

The responsible development and deployment of biotechnological innovations are paramount. This involves addressing ethical challenges head-on and establishing robust regulatory frameworks to ensure safety and equitable access.

Opportunities and Challenges in the Biotech Market

Investment Opportunities in Biotech

The biotech market presents a unique blend of high-risk and high-reward investment opportunities. Companies developing innovative therapies for previously untreatable diseases, or those pioneering advancements in gene editing or personalized medicine, often hold the potential for significant returns. Careful due diligence and a deep understanding of the scientific and regulatory landscapes are critical for navigating this complex market. Investors should focus on companies with strong intellectual property, robust clinical trial data, and a clear path to commercialization.

Identifying promising biotech companies requires a thorough analysis of their pipeline of drugs and therapies, their financial stability, and their management team. Investors should also consider the potential market size and regulatory hurdles associated with the products they are developing. Thorough research and a long-term perspective are crucial for successful investment in this dynamic sector.

Challenges Facing Biotech Companies

Biotechnology companies face a multitude of obstacles, from the significant costs associated with research and development to the lengthy and complex regulatory approval processes. Clinical trials can be costly and time-consuming, often stretching over many years, and the probability of success is never guaranteed. The high failure rate of drug candidates also poses a substantial challenge to profitability and investor confidence.

Furthermore, competition from established pharmaceutical companies and the need to secure sufficient funding to support ongoing research and development are constant concerns. These challenges require biotech companies to be highly innovative, efficient, and resilient to navigate the complexities of the market.

The Role of Venture Capital in Biotech

Venture capital plays a crucial role in financing the early-stage development of biotech companies. Venture capitalists provide seed funding and subsequent investment rounds, enabling companies to conduct research, develop their products, and prepare for clinical trials. This funding is essential for driving innovation and bringing groundbreaking therapies to market.

However, venture capital investments in biotech are often high-risk, with a significant portion of ventures failing to achieve profitability or market success. Investors in venture capital funds must be prepared for this risk and invest with a long-term horizon.

Regulatory Hurdles and Approval Processes

Navigating the complex regulatory landscape is a critical challenge for biotech companies. The stringent requirements imposed by regulatory agencies, such as the FDA in the US, mandate extensive testing and data validation before any drug or therapy can be approved for market release. This process can be lengthy, costly, and fraught with uncertainty.

The Importance of Intellectual Property Protection

Protecting intellectual property is paramount for biotech companies. Patents and other forms of intellectual property protection safeguard their innovative discoveries and inventions, ensuring they have a competitive advantage in the market. This protection is crucial for attracting investors and building a sustainable business model.

Strong IP portfolios are vital for licensing opportunities, collaborations, and securing future funding. Protecting their innovations is essential for biotech companies to compete effectively and achieve long-term success.

Market Trends and Future Projections

The biotech market is constantly evolving, driven by advancements in technology and a growing demand for innovative treatments. Personalized medicine, gene editing, and immunotherapy are major trends shaping the future of the industry. Investors should be aware of these trends and identify companies that are positioned to capitalize on them.

Future projections suggest continued growth in the biotech market, fueled by the rising prevalence of chronic diseases and the increasing need for targeted therapies. Staying informed about emerging technologies and market dynamics will be crucial for investors seeking opportunities in this dynamic sector.