Analyzing financial projections is paramount for evaluating synthetic biology startups. A critical review should delve into the assumptions underpinning revenue models and expense forecasts. Are these assumptions realistic given the current market landscape and the startup's unique value proposition? A detailed examination of the pricing strategies for products and services, coupled with a realistic assessment of production costs and scalability, is crucial. Evaluating the projected cash flow statements, including the timing of income and expenses, is essential to determine the startup's ability to sustain operations and achieve profitability within the projected timeframe. A careful analysis should also consider potential risks and uncertainties that could impact the projections.

Furthermore, scrutinizing the capital requirements and funding strategies is vital. The projections should clearly articulate the amount of capital needed to reach key milestones, and the funding plan should outline how the startup intends to secure this funding. A thorough examination of the startup's burn rate and its projected runway is essential to understand its financial sustainability. The projections should also include contingencies for potential setbacks, such as delays in product development or unexpected market challenges.

Key Performance Indicators (KPIs): Measuring Success

Identifying and analyzing relevant KPIs is essential for evaluating the performance of synthetic biology startups. Metrics like revenue growth, product adoption rates, and market share penetration provide insights into the startup's ability to capture market demand and achieve sustainable growth. Furthermore, evaluating metrics related to product development, such as time to market and the successful completion of key milestones, is critical to assessing the efficiency and effectiveness of the R&D process. A thorough analysis of these metrics will provide a comprehensive understanding of the startup's progress and potential for future success.

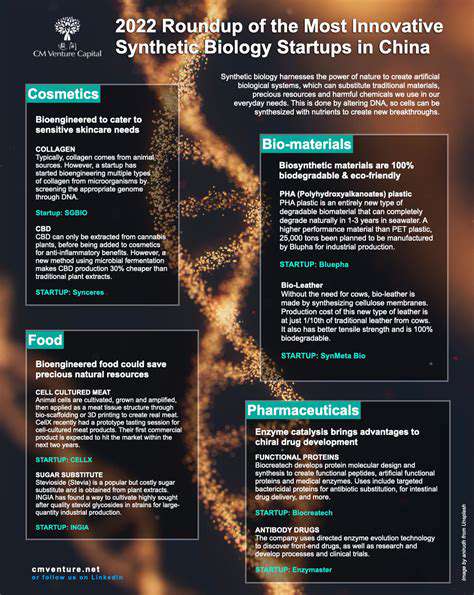

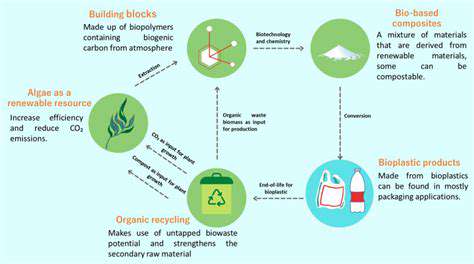

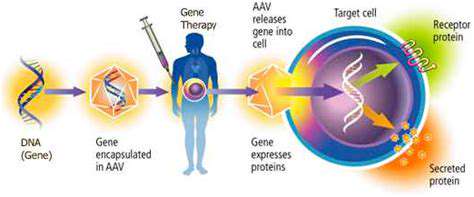

Beyond these core metrics, consider metrics specific to the synthetic biology field. These may include the number of successful genetic engineering projects, the yield of desired products, and the cost-effectiveness of the production processes. Tracking these metrics provides a unique perspective on the startup's technological advancement and its potential to disrupt existing markets. The analysis should incorporate industry benchmarks and competitor analysis to provide context for the startup's performance.

Market Analysis and Competitive Landscape

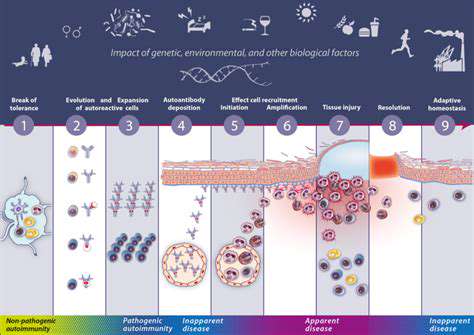

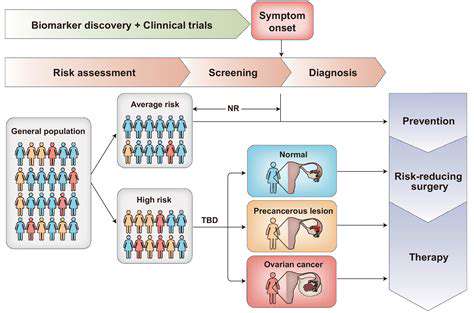

Understanding the market landscape is crucial for evaluating synthetic biology startups. The analysis should examine the size and growth potential of the target market, including the current market trends and future projections. Analyzing the competitive landscape is essential, identifying key competitors and evaluating their strengths and weaknesses. This analysis should also include an assessment of the regulatory environment for the specific products or services being developed by the startup.

A thorough understanding of the market dynamics, including customer needs, technological advancements, and regulatory hurdles, will help determine the viability and potential profitability of the startup's business model. Market analysis should also consider emerging technologies and potential disruptions that could impact the startup's market position.

Financial Sustainability and Funding Requirements

Assessing the financial sustainability of a synthetic biology startup is paramount. Evaluating the startup's ability to generate sufficient revenue to cover operating expenses, research and development costs, and expansion plans is essential. Determining if the startup's financial projections are realistic and achievable in the long term is crucial. A robust financial model that considers potential risks and uncertainties is necessary to evaluate the startup's financial stability.

Understanding the startup's funding requirements is also critical. Analyzing the amount of capital needed to reach key milestones, develop products, and scale operations is necessary for investor confidence and strategic planning. The funding strategy should align with the long-term financial projections and ensure the startup has adequate capital to weather potential economic downturns or market fluctuations.